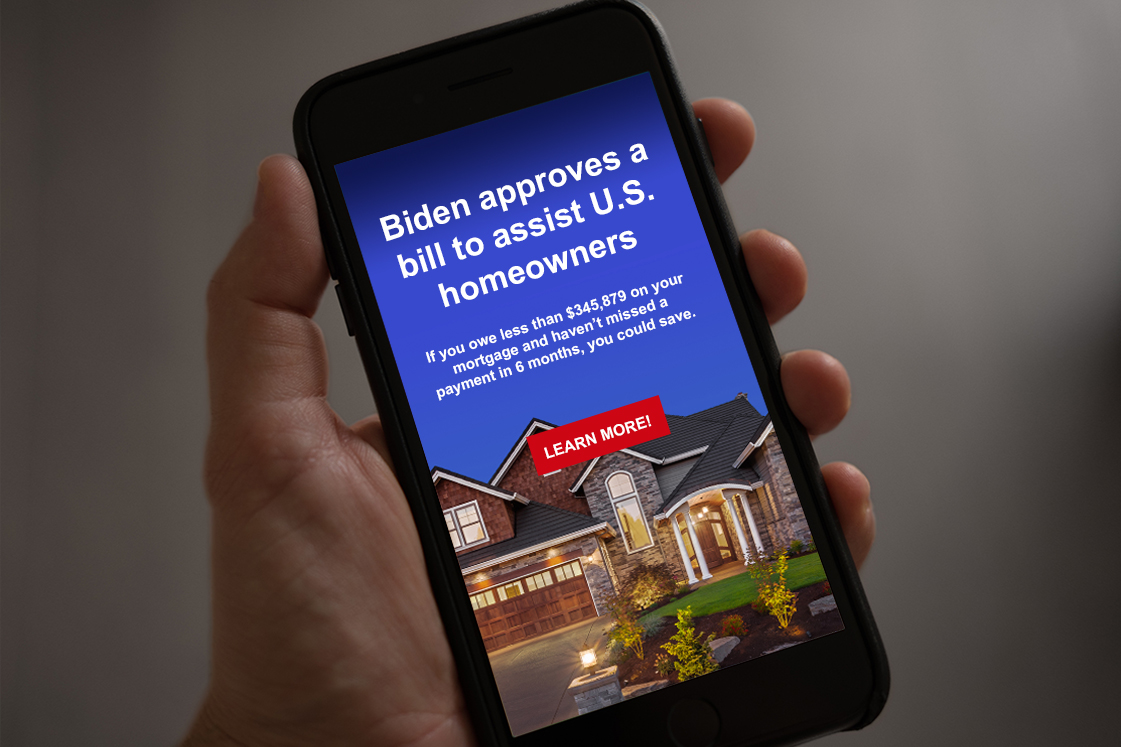

There are a lot of online ads saying some version of, “If you’re a homeowner who owes less than $300,000 on your mortgage and haven’t missed a payment in 6 months, you’re eligible for a mortgage relief program approved by Congress!”

What are these ads?

Normally, if you interact with these ads you’ll be redirected to a site that will ask you your home type, credit score, loan, zip code, and more. Then they give you a list of mortgage companies to contact. Basically, these ads are great at catching your attention (they’ve been around for over a decade) then funneling you to one of the mortgage companies that has helped pay for the ad. The overall goal of these ads is for you to refinance your loan with one of the mortgage companies they are working with.

If you interact with these ads, you’ll be bombarded with more of them on YouTube, TikTok, Facebook, Google… you’ll see them everywhere. They’re harmless, but they can be annoying.

Are these programs real?

Homeowners who aren’t able to make their mortgage payments do have options for help, but the claims in the ad are misleading. The mortgage amount they list and number of months of unmissed payments varies by ad and is there just to catch your attention so you click the ad.

Will the government help you pay less for your mortgage?

There are government relief programs available such as the Home Affordable Unemployment Program for unemployed homeowners, Principal Reduction Alternative, the Home Affordable Foreclosure Alternatives Program, and more. Every program requires documentation and approval to use. The ad makes you feel like it’s easy to qualify, and that’s just not the case.

What can you do if you’re struggling to make your payments?

Contact your home lender. Your local home lender is an expert in national, state, and community programs for assistance. In addition to assistance programs, you’ll likely hear about the two most common ways to keep your home if you are in a situation that makes it difficult for you to pay your mortgage: refinancing and forbearance.

Refinancing

When interest rates are lower than you’re currently paying, it’s always a good idea to consider refinancing. A refinance means you apply to take out another mortgage to pay off and replace your original loan. If your refinance is approved, you’ll pay a fee for closing costs. In return, if your new mortgage has a lower interest rate, you may have a lower monthly payment. You could also refinance to a mortgage with a different loan term to lengthen or shorten the amount of time to pay back your loan. Or you could refinance to a different mortgage program completely. As example, homeowners with 20% equity in their home could refinance into a conventional loan to avoid paying mortgage insurance fees.

A refinance will not damage your credit and may lower your monthly payments. It can be a great option to consider.

>> Learn more about refinancing

Forbearance

If you are unable to make your home payments, you can work with your lender to temporarily reduce or suspend your mortgage payments. This is called forbearance. Usually, your home lender decides whether you qualify for it and what the terms will be.

The ads you see likely play on the theme of forbearance. On occasion, Congress passes a bill to modify some terms for government-backed home loans – such as the terms for being able to go into forbearance. As an example, during the COVID pandemic, Congress put in place temporary mortgage relief under the COVID stimulus package. It’s called the CARES Act Mortgage Forbearance and applies to FHA, VA, USDA, Fannie Mae, and Freddie Mac government-backed loans (70% of homeowners have one of these loans). This bill is unique because it states your lender cannot deny your request for forbearance under the CARES Act or demand proof of financial hardship. So, it makes forbearance an option to everyone with a government-backed loan – no questions asked.

Whether you go into forbearance through government mortgage relief program or not, it will not reduce what you owe – you will have to pay back your missed payments in the future. Forbearance will appear on your credit history, but if you fulfill your part of the agreement, it won’t lower your credit score.

Can you refinance and go into forbearance at the same time?

If you get a forbearance through your lender, most of them require you wait three months after forbearance ends to refinance. If you do it through a government mortgage relief program (like the CARES Act) you may be allowed to refinance while being in forbearance. Talk to your lender to see what options are available to you.

If you or a loved one are having concerns about making mortgage payments, contact your trusted home lender.

If you have a loan through Mann Mortgage, your loan officer will want to hear about your concerns, understand your current financial situation, and offer solutions to help. Don’t struggle alone. We are experts in national, state, and community programs that can help you afford your home. We’re here to make it possible for you to buy, refinance, build, and keep a home.