Trusted, hassle-free home lending for over 30 years

Research Center

Learn about the most popular loan types with competitive rates and lower fees.

Affordable Down Payments

You could be eligible for a down payment as low as 3% for a range of borrowers and credit scores.

Expert Advice

Reliable, personal service from a mortgage expert who will go above and beyond to help you buy a home.

Apply

Our simplified mortgage app, makes applying for a home loan easy, fast & secure.

Loan Options For Everyone

Conventional Home Loans

Conventional

A conventional loan is available in a variety of loan term options and is advantageous for those coming in with a strong down payment and good credit history. This loan type is not insured by a government program such as FHA or VA.

Loan Program Details

- Get up to 97% of a home’s value

- Requires good credit and job history

- 5% - 20% minimum down payment

- Simple & secure online application

FHA Loans

A Federal Housing Administration (FHA) loan is insured by a government agency called the Federal Housing Administration, and offers financing to borrowers who may not be able to qualify for traditional loans. This loan is popular among first-time home buyers and those with less-than perfect credit, as it requires smaller down payments and feature more flexible terms.

Loan Program Details

- Down payment as low as 3.5%

- Low credit score qualifying

- Low closing costs

- Simple & secure online application

VA Loans

A Veterans Affairs (VA) loan, is designed to offer long-term financing to qualified American veterans, service members, and their eligible surviving spouses. These loans are insured by the United States Department of Veterans Affairs.

Loan Program Details

- 0% Down Payment

- No prepayment penalty

- Out-of-pocket expenses may be gifted

- Simple & secure online application

USDA RD Loans

If you’re purchasing a property in a rural area, you may be eligible for a United States Department of Agriculture (USDA) guaranteed loan (see eligible rural areas). This financing option is available for home buyers with low to moderate income.

Loan Program Details

- Up to 100% financing available

- Low closing costs

- Properties must meet USDA guidelines

- Simple and secure online application

Jumbo Loans

If you’re looking for a loan that exceeds the standard conforming limit of $417,000, you may need to look into a Jumbo loan. This option is typically used to buy that higher-priced luxury home.

Loan Program Details

- 15% minimum down payment (dependent on loan scenario)

- Lower debt-to-income (DTI) ratio

- Good+ credit

- Available for vacation homes to qualified borrowers

Reverse Mortgages

A reverse mortgage, or Home Equity Conversion Mortgage (HECM), is a type of home loan available to homeowners 62 or older who have considerable equity (usually at least 50%) in their home. This financial tool can benefit people who need additional cash flow for other expenses, as the value of their home’s equity can be converted to cash, eliminating monthly mortgage payments. Borrowers use the equity in their home as security for the loan, and can receive funds as monthly payments, a line of credit, or in a lump sum. This is called a "reverse" mortgage, because in contrast to a traditional mortgage, the lender makes the payments to the borrower.

Loan Program Details

- 0% minimum down payment

- Available to homeowners 62 and older

- Borrow up to 80% of the home’s value

- Used for primary residence

- Simple & secure online application

Renovation Loans

Renovation

A home renovation loan is a type of mortgage designed to finance both the purchase and renovation of a fixer-upper home at the same time, or to fund home repairs, additions, and more. Unlike traditional mortgages, the renovation loan’s interest rate is based on the value of the home after renovation is complete, allowing homeowners to tap into future equity to get the lowest interest rate possible. With a renovation loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies.

Loan Program Details

- 203K and HomeStyle Loans available

- Managed in-house

- Min down payment of 3% - 5% for single-unit homes

- Simple & secure online application

Construction Loans

Mann Mortgage is proud to offer stick-built contruction loans, which give borrowers a better option for building the home of their dreams. With a construction loan from Mann Mortgage, you’ll gain access to our collaborative, cloud-based construction loan software, which simplifies communication between you, the builder, 3rd-party inspectors, and title companies. You also get full-time support and real-time tracking for the construction phase of your financing through the building process, to ensure you stay on budget and on time with your construction loan.

Loan Program Details

- 5-10% down payment

- closing construction-to-permanent loan

- Collaborative, cloud-based construction tracking software

- Available with conventional, FHA, VA & USDA RD loans

- Simple & secure online application

Conventional Loan

VA Loan

FHA Loan

USDA RD Loan

Jumbo Loan

Construction Loan

Renovation Loan

Reverse Mortgage

Helping you finance your dream home

Mann Mortgage is a family-owned company that emphasizes honesty, integrity, and community. Since our founding in 1989 by Don Mann, we've been committed to helping borrowers like you find the best loan and fulfill the dream of home ownership.

Find Your Branch

Mann Mortgage has branches located in communities across the nation, with expert loan officers available to answer your questions. Find your branch and get in touch today!

Branch Locations

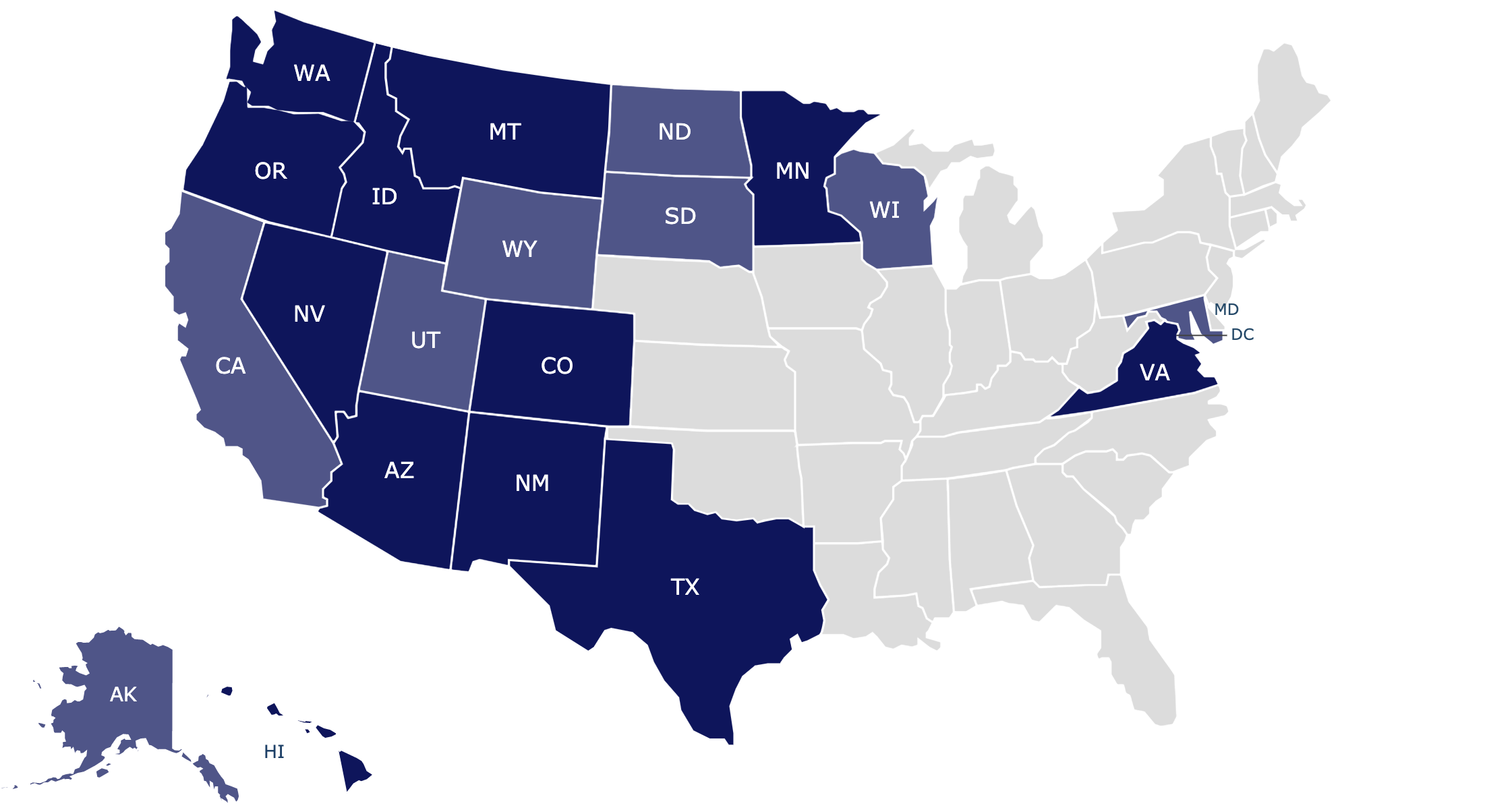

Licensed States

Coming Soon