Department of Veterans Affairs (VA) loans are available to current and previous U.S. military service members and their spouses for financing a home. The loan is given by an independent mortgage company or bank, and the Department of Veterans Affairs guarantees a portion of the loan will be paid back if the borrower defaults. That guarantee makes VA loans less risky for lenders and it is what allows it to be offered without a down payment requirement by your mortgage lender.

Are VA loans a good deal?

Like all loans, it depends on you and your financial situation. There are some benefits to VA loans that many people may want to take advantage of while other veterans may find a different type of loan works better for them. The chief benefits of a VA loan are:

- You don’t need a down payment

- You don’t need a perfect credit score

- You can have a higher debt-to-income ratio

- You don’t need to pay monthly mortgage insurance

- There’s no limit to the loan amount

- It can be used to purchase a second home with no down payment (it’s called the VA bonus entitlement)

The catch

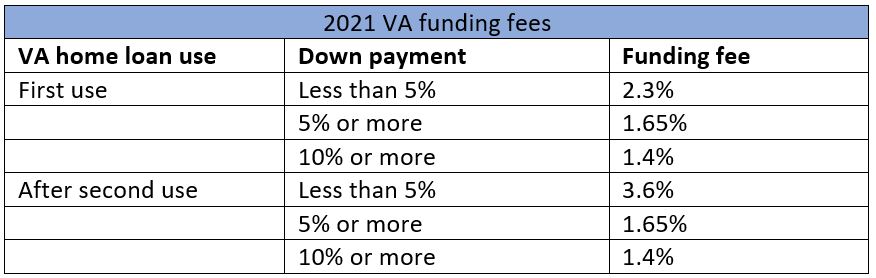

With all good deals, there’s a catch. For VA loans, you’ll have to pay a small funding fee (2.3% if you put 0% down) to offset the loan program. This is a one-time fee that will be paid at closing or rolled into the mortgage amount (which will increase the monthly payments and interest paid over the life of the loan). This fee is waived for anyone with a service-connected disability.

Should you get a VA loan?

Whether a VA loan is right for you depends on your unique financial situation. If you have money for a down payment, you may be better off getting a different type of loan. Contact your local loan officer and together you can go over your options and pick the best one for you.