A down payment is a minimum cash payment a buyer makes during the closing process to secure a loan on a home purchase. Down payment requirements vary for different types of loans, and can range from as low as 0% of the total purchase with a VA loan to as much as 20% or more for conventional or jumbo loans. Similar to your mortgage rate, your down payment amount will be determined in large part by your credit score, the purchase price of the home, and the type of loan you and your loan officer determine will help you the most given your circumstances.

The amount you need depends on the type of loan you get. Below are the six most common types of home loan options and their minimum down payment requirements.

Conventional loan

Minimum down: 3%

These loans are used for purchasing a primary residence, secondary home, or investment property. Though you can put down 3%, you will have to pay private mortgage insurance (PMI). It ranges in cost from 0.55% to 2.25% of the original loan amount per year and is broken down into monthly payments. It ranges in cost from 0.55% to 2.25% of the original loan amount per year and is broken down into monthly payments. Once you own 22% of your home, you can stop paying PMI. You can avoid PMI altogether with a 20% down payment.

FHA loan

Minimum down: 3.5%

Depending on your credit score, you may be able to secure a loan guaranteed by the Fair Housing Administration (FHA) with as little as a 3.5% down payment. FHA loans are available to people with lower credit scores (as low as 500), higher debt-to-income ratio (up to 50%), and with smaller down payments than some conventional loans allow. FHA loans allow the money for a down payment to come from a gift or charitable organization. Borrowers will need to pay an annual mortgage insurance premium (MIP) of between 0.45% to 1.05% of the loan amount – this fee will be paid annually but broken down into 12 payments and added to the monthly mortgage bill. If borrowers put down a 10% down payment, they’ll pay MIP for 11 years. If they put down less than 10%, they’ll pay MIP for the lifetime of the loan.

Jumbo loan

Minimum down: 20%

When someone needs a loan for more than conforming loans allow ($548,250 is most states), a jumbo loan is an option. Since they are too large to be guaranteed by Fannie Mae or Freddie Mac, qualifications to get this loan are tight and borrowers will need an excellent credit score. A 20% down payment is standard, but some lending institutions may require more.

USDA loan

Minimum down: 0%

These loans are designed to improve the economy and quality of life in rural America. If you’re buying a primary residence in a rural area, you may qualify for a USDA loan. You’ll need a credit score of 640 (though some lenders will offer loans for less) and meet income restrictions for the area you’re buying in. Borrowers will pay an annual fee equal to 0.35% of the loan balance (broken down into 12 monthly payments and added to the mortgage bill) as well as a one-time funding fee of 1% of the loan amount due when the loan closes.

The USDA provides this color-coded map to show which areas they classify as “rural”.

VA loan

Minimum down: 0%

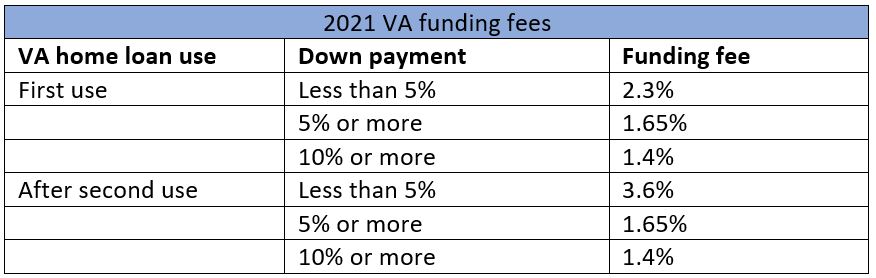

If you’re an active member or veteran of the U.S. military (or a surviving spouse) you may be eligible for a Veterans Affairs (VA) loan. The VA doesn’t set a minimum credit score requirement for VA loan eligibility, but lenders typically will. Normally, it’s around 660, but you’ll need to check with your individual lender to see what their qualifications are. Borrowers will need to pay a one-time funding fee of 1.4% to 3.6% of the loan amount and can be paid upfront or rolled into the loan amount. There are no private mortgage insurance fees associated with a VA loan.

What’s the right down payment for you?

Finding the down payment amount depends on your financial goals, your loan eligibility, and other factors. Work with your loan officer at Mann Mortgage to identify the loan programs you qualify for and to help you decide which is best option for achieving your home buying goals.