It’s just a matter of time before everything breaks down. But being aware of how long you can expect your household items to last will allow you to plan for repairs and replacements. Luckily, we don’t have to guess. The folks over at International Association of Home Inspectors have done the research for us. They have a very comprehensive list, and we’ll go over the highlights below.

Oven

Gas range: 15 to 17 years

Electric range: 13 to 15 years

In addition to lasting longer, gas ranges are three times more energy efficient than electric. Some consumers don’t appreciate they’re run off fossil fuel, though it’s less than 3% of household natural gas use in the U.S.

Refrigerator

9 to 13 years

A quality fridge can last up to 20 years, but generally people find they start seeing signs of wear around 10 years. See the nine most obvious signs you’ll need a new fridge.

Dishwasher

9 years

Some brands claim their units last up to 20 years. Regardless of the brand, to get the most life out of your dishwasher you need to clean it. Wash the filter, remove trapped bits of food, use a dishwasher cleaner, or just run the clean cycle regularly.

Sliding glass patio door

20 years

They let in lots of sunshine, bring the outdoors in, and they’re a staple in modern home designs. Sliding glass patio doors, with their floor to ceiling windows, are beautiful additions to a home. Find out how to keep yours securely locked with these tips.

Carpeting

8 to 10 years

Consider yourself lucky if your carpet lasts more than a decade. One of the first signs it’s time to update your flooring is that it begins to matte down in high traffic areas. There’s not much you can do to fix it once that happens. Before it mattes down, follow these tips to keep it looking as good as possible.

Wood flooring

100+ years

Every 5 to 10 years, you’ll have to re-coat or fully refinish your floors to keep them looking beautiful. Beyond that, the floors will last longer than your lifetime. If you need tips on finding the hardest and most durable wood floors, check out this helpful post.

Vinyl flooring

25 years

Vinyl flooring is having a real revival. It’s easier to install and more affordable than wood or tile. There are plenty of designs to choose from: wood, metal, or concrete styles. For a bold look, retro-patterned vinyl flooring can look incredible. See some fun retro kitchen ideas you could create using vinyl flooring.

Garage doors

25 years

How long yours will last depends largely on how often it’s used. After 10,000 open/close cycles (that’s four times daily for 6-7 years) you’ll want to replace your springs. Beyond that, your door’s lifespan is based on its quality, the climate, and how well it’s maintained.

Detectors

Carbon monoxide: 5 years

Smoke/heat: less than 10 years

Make sure you change the battery every year, but the units themselves have a slightly longer lifespan. If your detector is beeping, address it right away. Each beep pattern means something a little different. Find out what they mean here.

Toilets

Toilet: 100+ years

Tank components: 5 With good care, toilets will last as long as your house. But if you’ve got a toilet manufactured prior to 1980, you might want to get a newer unit. They use 5 to 8 gallons per flush. A newer unit built after 1992 uses only 1.6 gallons per flush – a savings of 9.1 gallons per day per toilet.

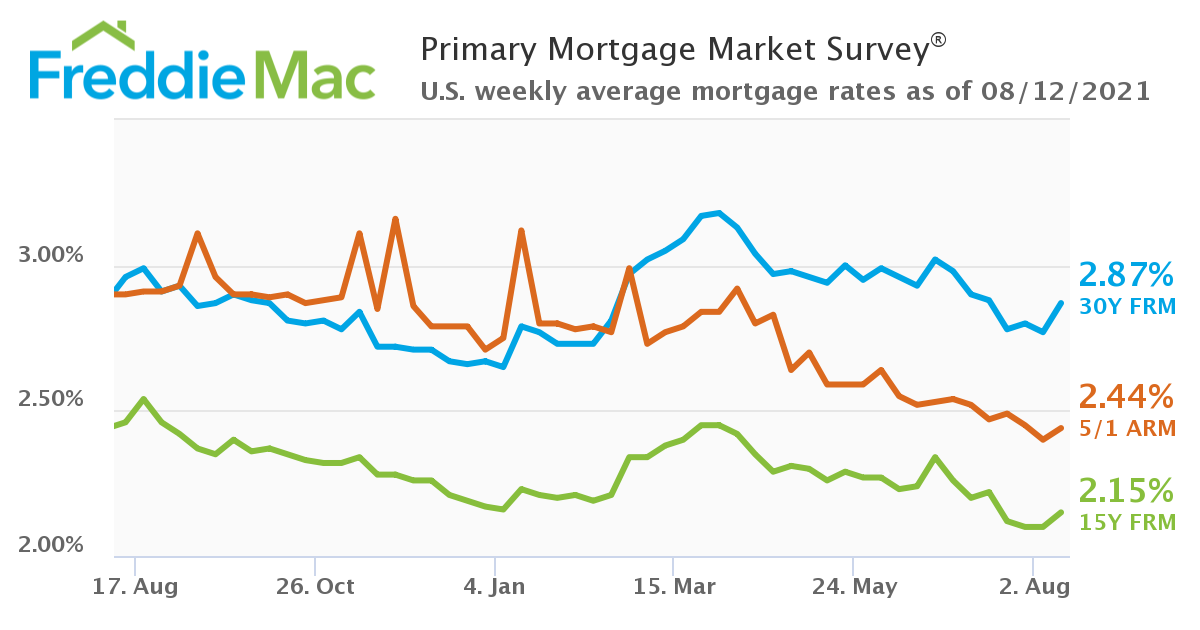

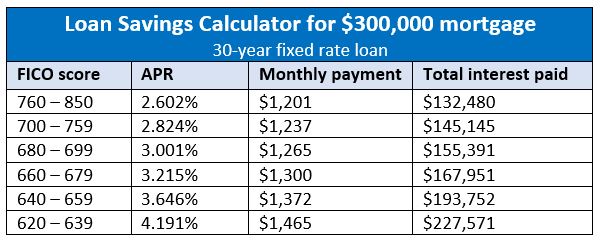

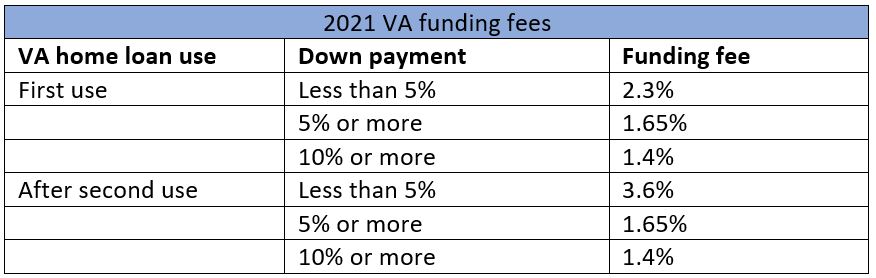

With interest rates staying low, now is a great time for a renovation loan to update items that are starting to show their age. Find out more about renovation loans and how much the most common renovations cost.