Buying a house is a big life event. To make sure you start your journey on the right foot, we’ve put together a few things you’ll want to do before you step into your first open house. If you follow our tips, you’ll set yourself up to get the right type of home and home loan.

Check and improve your credit score

Your credit score (sometimes called a FICO score) will be used by your mortgage company to decide if you’re eligible to receive a loan and, if you are, the interest rate you’ll get. Scores range between 300 and 850 – the higher the score, the better. If your score is under 500, you have what’s called “challenged credit”. It’s not impossible to buy a home, but you’re going to struggle. Learn about buying a home with challenged credit. In general, the lower your score, the higher down payment your mortgage company may require.

Check your score for free once a year at annualcreditreport.com. If it’s low, you’ll need time to raise it. You can start by doing the following:

- If you don’t have a credit history, get one. Take out a credit card and make your payments on time to show you’re credit-worthy. Not having a credit history can give you a very low credit score.

- If your credit cards are maxed (or almost maxed) you’ll need to start paying them off. Using too much of your available credit can lower your credit score.

- Pay bills on time. If your payments become 30-days past due they will likely be reported to the credit bureau and lower your credit score.

Decide where you want to live

Do you want to stay in the city, county, or state you’re in? Take a little time to research your options and make sure you know where you want to be for the next few years.

Contact a local mortgage lender

Working with a home expert who has connections in your community is always a great idea. They’ll know the local and state first-time homeowner and down payment assistance programs that can save you a lot of money – and that’s in addition to all the national loan and assistance programs. Together, you will go over your credit, income, and financial goals to find the best home loan.

Save for your down payment

The amount you need to save for a down payment depends on the type of loan you select and your financial situation. It can range from 0% of the total purchase price for a VA loan to as much as 20% or more for conventional or jumbo loans. Many people mistakenly assume you always need 20% down to purchase a home, and that’s just not the case.

Some people may chose to put as much down as possible while others will put the minimum down. Which is right for you? You and your loan officer can go through the pros/cons of each scenario to help you decide.

>> Get the scoop on how much you’ll need for a down payment.

Get pre-approved

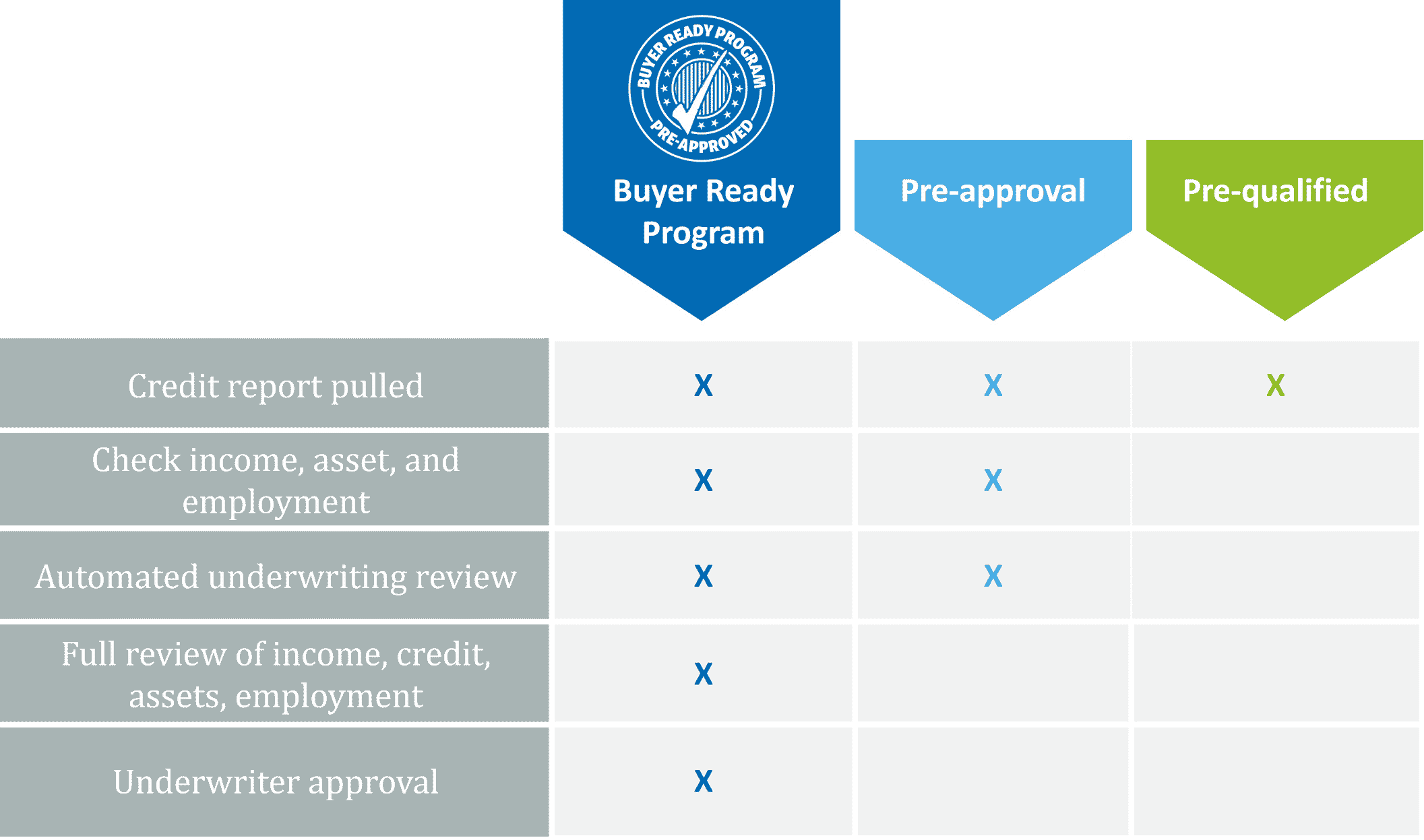

Being pre-approved means your lender has already looked at your income, assets, debt, and credit report to decide how much they might be willing to lend you. It’s never a guarantee of a loan, but it’s much better indication (for both you and the person you’re buying from) that you’ll be extended a loan if you make an offer on a house.

>> Don’t make these first-time home buyer mistakes

Find a real estate agent to represent you

Once you’re a client, agents have a fiduciary responsibility to you. That means they are legally obligated to put your best interests first. They will know what to look for with a property and neighborhood, they will help you negotiate the price, and they will help you navigate the paperwork and legal issues with making an offer and purchasing a home.

After those steps are done, you’re ready to be a serious buyer with competitive offers on your next home.

Wherever you are on your journey to purchase a home, reach out to us. We are happy to go over your finances and goals and help you navigate the home loan process.