While your marital status doesn’t directly impact your score, disentangling your finances while you’re separating from your spouse might. What are the most common issues that can lower your credit score during a divorce?

Missing a payment on joint credit

If you’re like most married couples, you and your spouse have a mortgage, auto loans, and credit cards in both your names. Your creditors extended credit to you based on your joint financial information. When it comes to making payments for your debts, your creditors don’t care whether you’re separating or not. Your payment history is the biggest factor in your credit score (about 35%), so it’s in your best interest to make sure yours helps, not hurts, your score.

What you can do to minimize the negative impact on your credit:

As soon as you can, check your annual credit report (it’s free) to see which accounts are in your name.

Continue to make, at least, minimum payments towards credit debts you’re responsible for. With all the commotion of separating, it’s easy to forget about your bills. But missing a payment now can lower your credit score and make it less likely you’ll be extended credit in the future.

As your divorce progresses, a judge may issue a divorce decree. It’s a contract between the court, you, and your spouse to say who is responsible for each debt. With it, you may be able to exclude some debt or define who is responsible for payments. In most states, you may only be responsible for debt with your name on it or that you’ve made payments towards in the last 12 months. But if you live in Arizona, California, Idaho, Louisiana, Nevada, New Mexico, Texas, Washington, or Wisconsin, your assets and debt will be split 50/50 for anything acquired in the state while you were married – no matter whose name is on the debt.

If you and your spouse have a mortgage together, let your loan officer know if you need to make changes to your loan. They can help you go over your options to refinance in one spouse’s name only.

Transferring credit card balances

Another factor that impacts your credit score that people often forget is the total amount of credit that’s available to you compared to how much of it you’ve used. It’s called your credit utilization ratio, and it represents about 30% of your FICO score.

Imagine you have $2,500 in credit debt split between two credit cards that each have a $5,000 limit. You have $10,000 available credit, you’ve got $2,500 in debt, and your credit ratio is 25%. If you transfer your debt and close one card, you still owe $2,500 but your available credit is now cut in half – just $5,000. Even though you didn’t spend any more money, you’ve now used 50% of your available credit. This change can certainly negatively impact your credit score.

What you can do to minimize the negative impact on your credit:

Transferring your balance to an existing card with a lower interest rate is a great idea to help you pay off your debt faster. To keep from taking any hits to your credit score, consider keeping your old credit card open even if there is no balance.

Closing old credit cards

Your average account age is another factor in your credit score (around 15% of your FICO score). Your oldest credit cards show you can continue to make payments over an extended amount period of time. When you close them, you reduce your average account age and can lower your credit score.

What you can do to minimize the negative impact on your credit:

Consider not cancelling any of your credit cards (even when they’re paid off entirely or you’ve transferred the balance). You will keep the positive benefits of your credit utilization ratio and account age intact, which means you won’t take hits to your credit score.

Looking to buying a home after a difficult divorce?

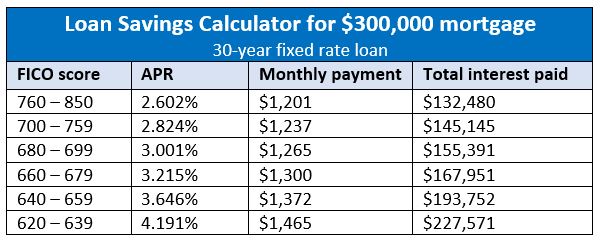

Your credit score is just one factor your lender uses when deciding whether you’re eligible for a loan. If you’re unable to minimize the impact on your credit score after a divorce, there are still ways to move forward with a home loan. We’re experts in finding the right federal, state, and even local programs to help you afford a home. Talking to us about your home finances is free whether you have a loan with us or not. When you’re ready, give us a call and we’ll go over your home options no matter what your credit score is.