Getting approved for a loan is the best way to be prepared to purchase your next home. When you work with your lender, almost all of them offer traditional programs to either pre-approve or pre-qualify you for a loan.

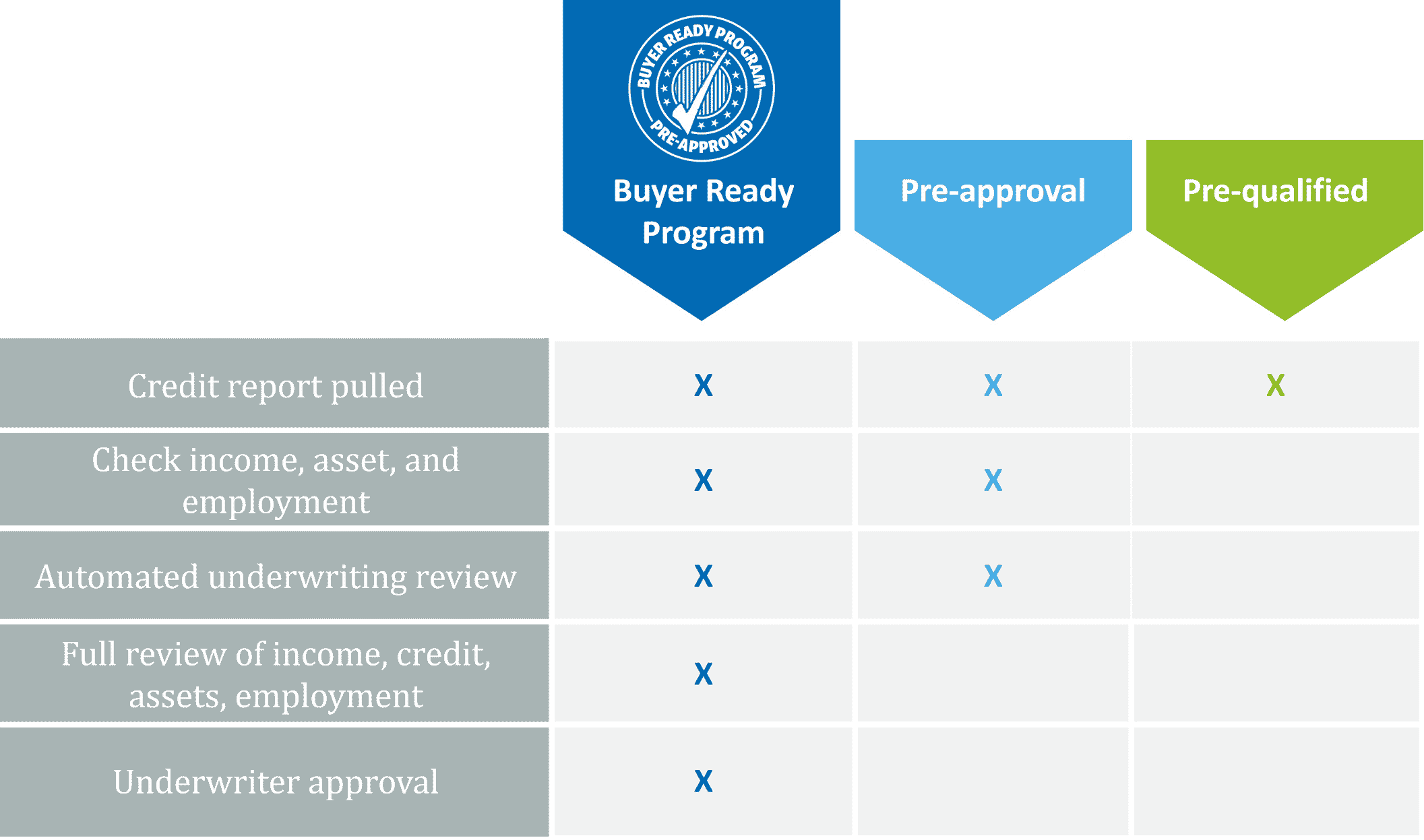

Pre-qualify: Traditionally, this means you credit is checked to see whether you have a credit score that would meet the minimum qualifications for a home loan.

Pre-approve: For most lenders, in addition to your credit score being checked, your income and your employment history will also be given a preliminary review by an automated underwriting program. This type of approval is generally considered stronger since it’s a more detailed process.

The issue with the traditional pre-approval programs is your financial data is checked, but it’s not completely reviewed. There’s still a final step that needs to take place once you apply for your loan: an underwriter needs to do a full personal review of all your data. It’s possible they may find issues that were missed during the automated review. Resolving these issues takes time and lowers your strength of your home purchase offer.

The Buyer Ready Program: the strongest pre-approval you can get

We offer the Buyer Ready Program which is the most detailed approval a lender can offer to you. What makes it unique is we have an underwriter do the complete review of your financials to make sure they address any issues upfront rather than after you put in your home offer. That means your offer is stronger, less likely to run into financing issues, and more likely to be accepted by the seller.

>> What you should never do after you’re pre-approved for a loan

The best pre-approval can help you get a home

We understand how competitive the buyer’s market is, and we want to do everything we can to make sure your purchase offer is strong and appealing to the seller. As a hometown lender, we have years of experience working with our local Realtors. When they see your offer is backed by our Buyer Ready Program, they know it’s stronger than any pre-approval or pre-qualified offer another buyer has. In today’s market, any advantage you have is worth taking! And, best of all, we offer this program at no cost to you.

>> Closing on a home – how to prepare

Contact us today to learn more about the program and, when you’re ready, we’ll qualify your home loan through the Buyer Ready Program.