Buying a home with bad credit can be a challenge, but it’s not impossible. Your credit score – whether it’s good or bad – is just one of the factors your home lender will use to decide whether you’re eligible for a loan.

What is a bad credit?

Bad or “low credit” typically means your FICO score is under 600. FICO credit scores range from 300 to 850 and represent how likely you are to pay back a loan. Your score is calculated based on your payment history, amount owed, length of your credit history, new credit, and the mix of credit you have. Your score is used by lending agencies to determine whether you’ll be eligible for a loan and at what interest rate. The closer your score is to 800, the more loan options and lower interest rates you’ll have access to. Lenders tend to define the scores as:

Exceptional: 800+

Very good: 740 – 799

Good: 670 -739

Fair: 580 – 669

Very poor: 300 – 579

To check your credit report annually, you can visit annualcreditreport.com to see what your current FICO score is. It’s free to use once a year and it won’t impact your credit rating.

What’s the minimum credit score needed for a home loan?

There isn’t a universal minimum credit score needed to get a home loan. Instead, each mortgage lender decides the minimum credit score they’ll accept. But when a score is under 600 it’s classified as “subprime” and your loan options drop significantly. A score under 550 is going to have very limited loan options with very high interest rates.

Other factors mortgage companies use

Besides your FICO score, a lender will evaluate how much money you have for a down-payment, how much debt you already have, your credit history, and your income. To increases your chances at getting a loan with bad credit, the best option is to have as large a down payment as you can afford to minimize your risk to the lender.

A potential borrower with a low credit score but a sizeable down payment and a decent credit history is more likely to be approved for a loan than someone with low credit, a small down payment, and no credit history.

How much more will bad credit scores cost in the long run?

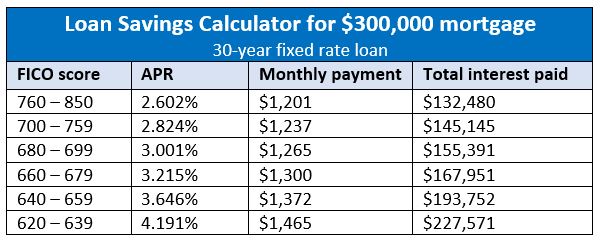

Since early 2020, interest rate on mortgages have dropped. Lower mortgage rates mean smaller monthly payments for principal and interest – and a lower cost for the loan over its life. That said, there’s still a big difference between how much someone with good credit will pay compared to someone with a bad credit score.

From the chart below, you can see a borrower with a credit score of 639 will end up paying $95,091 more in interest over the lifetime of the loan than a borrower with a credit score of 760.

What home loans are available to someone with bad credit?

FHA loans are insured by the Federal Housing Administration and are designed specifically for borrowers with low credit and lower-to-middle income. You’ll need a down payment to qualify for FHA loans, but your mortgage lender may be able to secure a loan through them even if you have a FICO score as low as 500.

The best way to evaluate your loan options is to speak with a local mortgage expert. Based on your financial goals, loan eligibility, and local real estate conditions, they’ll be able to help you find the right loan for your needs.