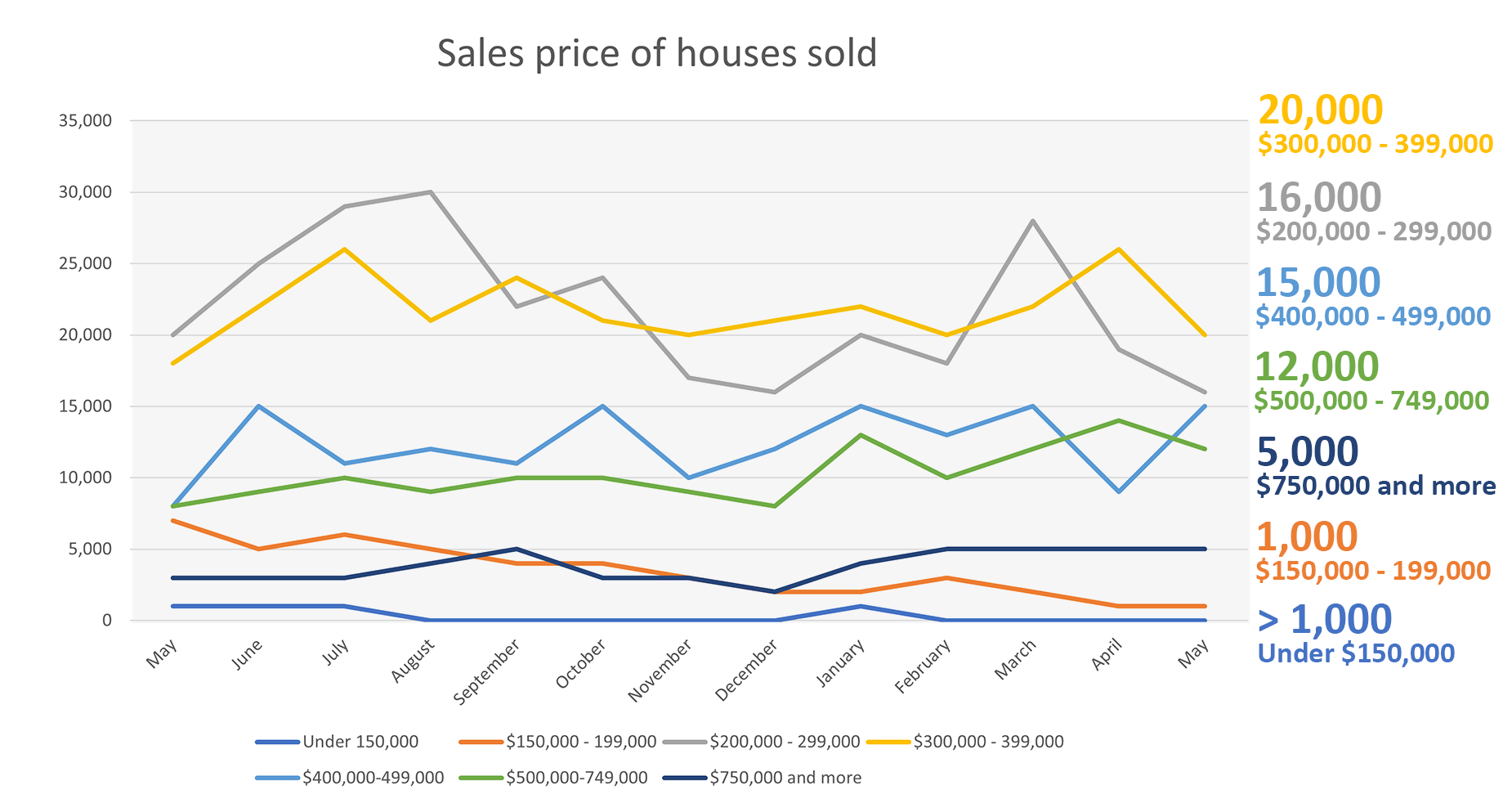

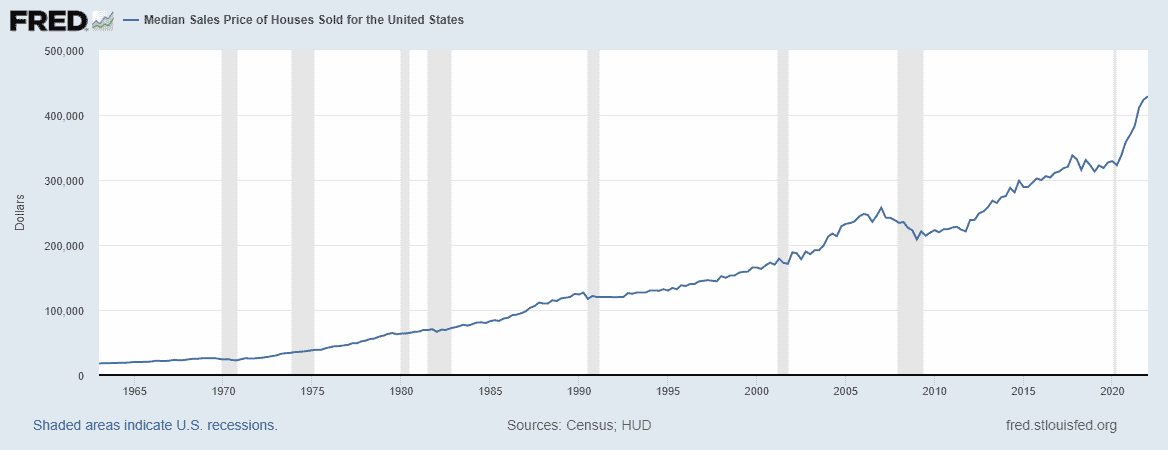

If you’re staying out of the housing market because you’re afraid home prices will “crash”, take a moment to review the chart below.

It’s from the Federal Reserve Economic Data. They’ve been tracking average sale prices of home in the U.S. since 1965.

Are there dips in home prices? Of course. From the first part of 2007 to 2009, the average home value decreased $49,000. But just three months into 2009, home values were on the rise again. And again in 2017, home values decreased slightly for three years until they took a sharp increase the final months of 2020.

If you’re like the average homeowner, you’ll stay in your home a minimum of 10 years. Will a shift in monthly or even annual home values matter if, after a decade, your home’s value will very likely increase? Probably not.

Home prices increase over time

Can you time when you’ll purchase a home in order to get it at the best price possible? Of course. But generally, the longer you wait the more expensive the home will be. Historically, even over the course of a year, a home price will increase.

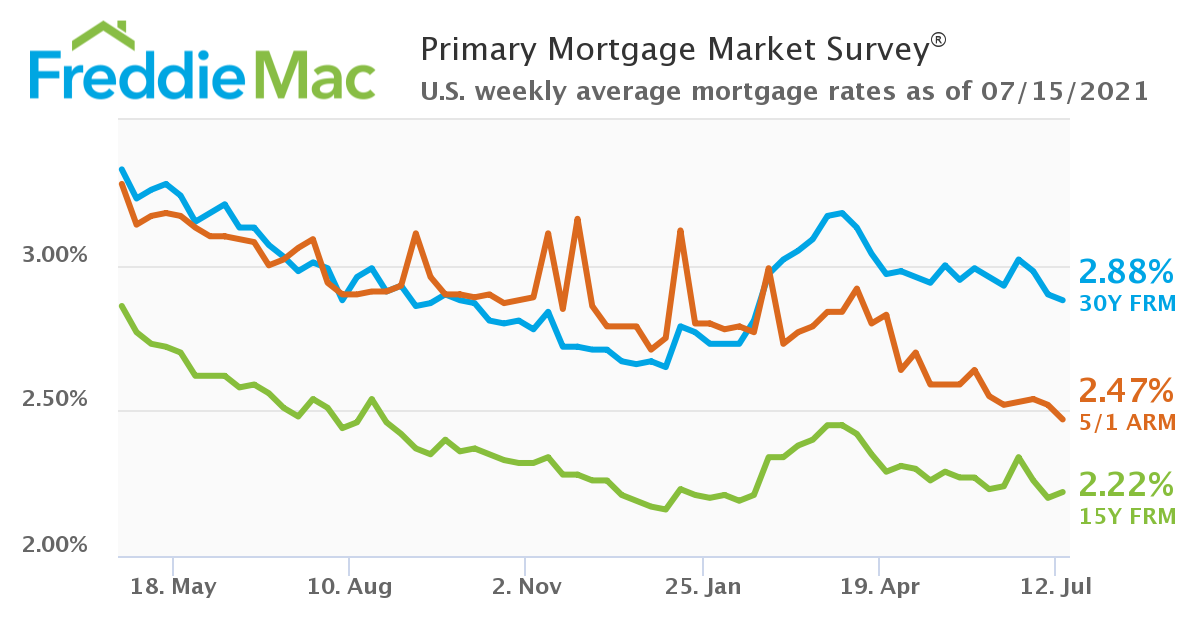

Let’s imagine you’re the average homebuyer purchasing a house, then selling it 10 years later. What would be the average price of the home and interest rate for a 30-year loan look like from the time you bought to sold?

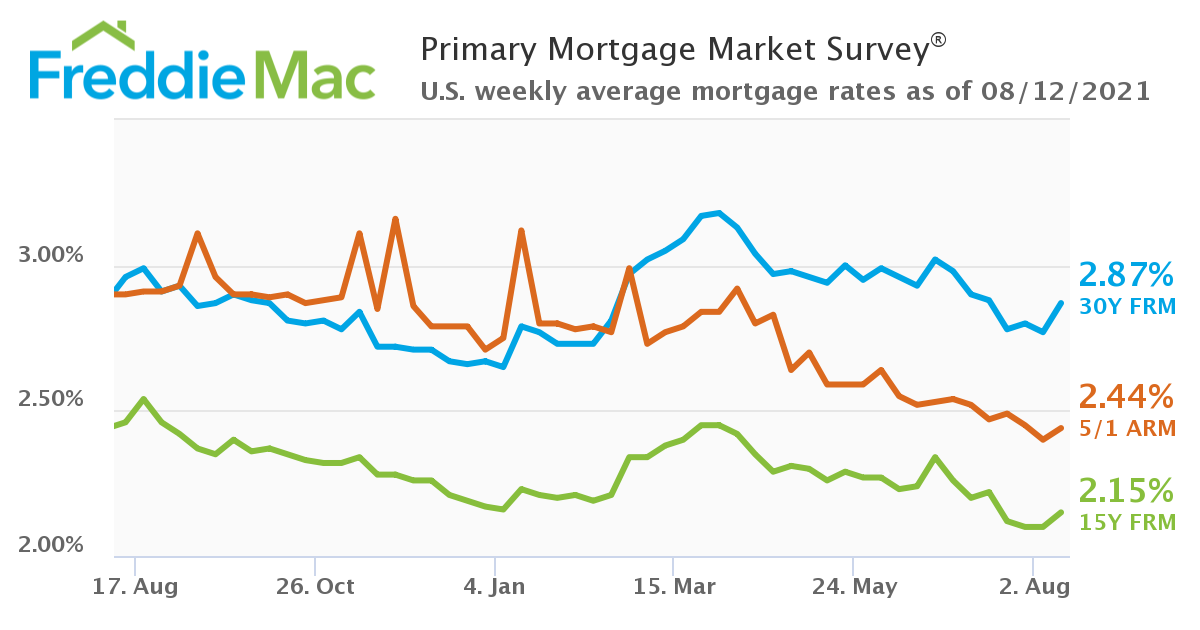

In January of 1982 the average American home price was $66,400 and the interest rate was 17.48%

In January of 1992 the average American home price was $119,500 and the interest rate was 8.76%.

In January of 2002 the average American home price was $118,700 and the interest rate was 7%.

In January of 2012 the average American home price was $238,400 and the interest rate was 3.92%.

In January of 2022 the average American home price was $428,700 and the interest rate was 3.45%.

When is the best time to buy a home?

Knowing home values increase over time, the sooner you get a home the lower the price will likely be. There are certainly a lot more things to consider when purchasing a home, but you probably shouldn’t expect to wait it out for a few years and expect a lower sale price.

>> How to get ready to buy a house this year

If you wonder when it’s the best time for you to purchase a house based on your credit, income, savings, and other factors; then it’s time for you to talk to a local mortgage expert. A loan officer will go over your unique financial situation to select a loan that will work best for the type of home you’d like to buy. Talking with a loan officer is free, so we recommend reaching out to a local one now to be ready to buy a house in the future.

Don’t have a loan officer to work with? Find a local mortgage expert near you here.