If you are having difficulty saving for a down payment on a new house, you should look into the USDA Rural Development Loan. USDA home loans provide mortgages with no down payment for rural homebuyers. It is ideal for people with modest incomes who do not wish to live in a city or metropolitan setting. This initiative has assisted many people who would not have been able to acquire a home otherwise. Read on to find out about the eligibility criteria and how you can apply!

What are the Eligibility Criteria for a USDA Loan?

To be eligible for the USDA Guaranteed program, you must:

- Be a permanent resident of the U.S.

- Be constructing or purchasing a home in a rural location.

- Have a household income that falls within the program’s guidelines for your area.

- Have a minimum credit score of 640.

- Live in the house as your main residence.

How Do You Apply for a USDA Loan?

If you satisfy the USDA loan qualification requirements and are ready to buy a property, follow these steps:

Contact a USDA-Approved Lender

If you want to construct a house, locating a USDA-approved lender is a good place to start. Working with a lender who specializes in the rural home program can have a significant impact on prospective homeowners.

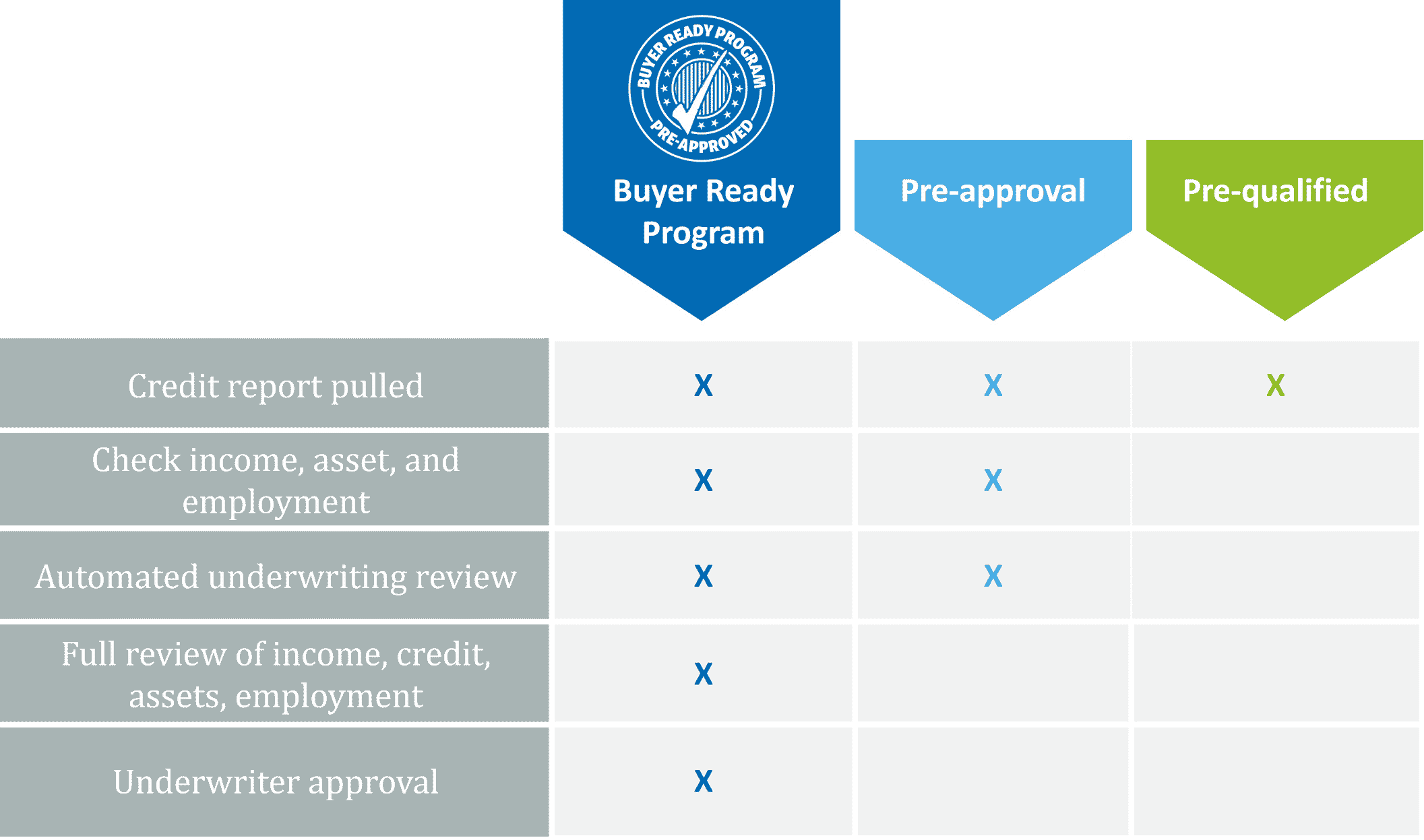

Get Prequalified

Once you’ve decided on a lender, the next step is to become pre-qualified. Pre-qualifying for a USDA loan is a straightforward process that offers an estimate of what you can pay and whether you are eligible for the program. During this phase, your lender will examine your affordability and notify you of any red flags that may prevent you from securing a USDA loan.

Find a House in a USDA-Approved Neighborhood

After you become pre-qualified, look for a property in a USDA-eligible neighborhood and put in an offer. Your requalified letter demonstrates to sellers and brokers that you are a lender-verified USDA buyer who is ready to close.

Sign a Purchase Agreement

After you’ve found the ideal home, you’ll collaborate with your lender and agent to submit an offer. Your lender will request a USDA loan appraisal as soon as you and the seller sign a purchase contract. The appraiser will make certain that the house is move-in ready and that it fulfills USDA requirements. If anything does not match industry standards, it must be corrected before the closing.

Complete Processing and Underwriting

After you have signed the contract, an underwriter will check your information and the file to ensure that your application and supporting papers are authentic and correct. Because the USDA program employs a two-party approval system, the underwriting procedure for USDA loans may take longer than for traditional mortgages. The loan file will first be reviewed by your lender to make sure it complies with all USDA standards. They will then certify the file, either automatically or manually.

Close the Deal

When both the lender and the USDA approve your loan file, you’ll get a “clear to close,” which indicates you can proceed to closing day. You’ll sign the loan note and other documents on closing day and receive the keys to your new residence.

If you’re unsure if you and your proposed property are eligible for a USDA loan, contact us today!