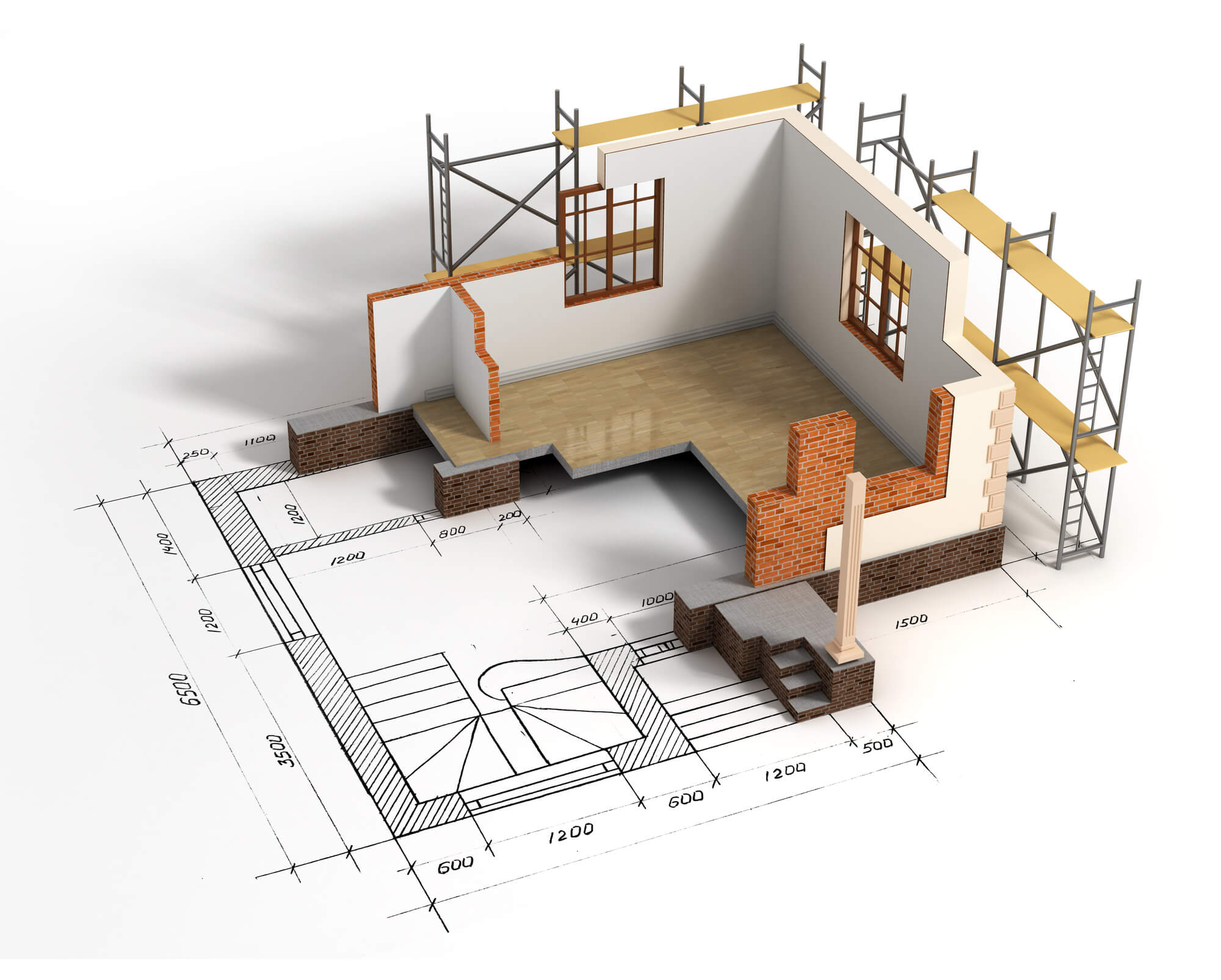

Perhaps, you may have been thinking of having your dream home now. You may already have a very specific detail in mind of how you would like everything to turn out. But house hunting doesn’t give you anything akin to your preference. This is maybe a go signal for you to build it on your own. However, building a house from scratch is a tough nut to crack. To ensure that your house would be built continuously, you must have enough funds for it to be a reality. That said, a construction loan would probably be your best bet to create the home of your dreams.

A construction loan is a short-term financing solution for the construction or renovation of your home. This can cover the costs of building it from the very beginning until it is completed. If you are interested, there are some steps you need to go through for you to be qualified for a construction loan. Here are the three steps to follow through and make sure you won’t miss a thing.

Determine Your Budget

Before anything else, you have to determine your allotted budget for your house project. Have everything calculated, such as the land cost, materials, labor, and other expenses. Once you have a better grasp on how much you need, you may now determine the whole budget for your project. Because there’s no collateral for this as the house is not yet built, make sure your income is enough for you to pay accordingly.

Eligibility for Construction Loan

The second thing that you need to do is to know if you are qualified to apply for a construction loan. Keep in mind that, unlike traditional loans, construction loans are much more stringent when it comes to this. There is so much risk to the lender. For you to be qualified, you have to tick off all the requirements here in the following:

- Good credit

- Sufficient income to pay off the loan

- Low DTI (Debt-to-income ratio)

- At least 20% or a down payment

Gather Your Documentation

To apply for a construction loan, you must provide documentation such as your personal financial statements, tax returns, building plans, cost estimates, and proof of land ownership. Make sure you have all of these documents ready before you apply.

Apply For The Loan

Once you have chosen a lender and gathered your documentation, you can apply for the loan. The lender will review your application and documentation, and may request additional information or documentation as needed. If your application is approved, the lender will provide you with a loan agreement that outlines the terms and conditions of the loan.

Monitor The Construction Process

After you have received the loan and started the construction process, it’s important to monitor the progress of the project and ensure that the work is completed according to plan. The lender may require periodic inspections and progress reports to ensure that the funds are being used appropriately.

In conclusion, securing a construction loan requires careful planning and attention to detail. By following these 5 steps, you can increase your chances of getting approved for a construction loan and ensure that your dream home becomes a reality. At Mann Mortgage, we are dedicated to giving you the best option to make your dream home a reality. Feel free to contact us for more trusted information.