After negotiating the price of a new house and being approved for a home loan, some people opt to purchase mortgage points to lower the interest rate and save on the overall cost of their loan.

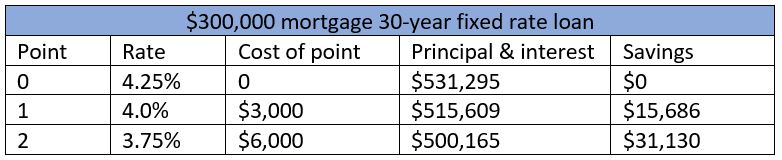

Mortgage points are a fee a borrower can pay their mortgage lender to lower the interest rate on their home loan. Each point lowers the interest rate around 0.25% and costs 1% of the mortgage amount. The points are paid for when the loan closes. A full point, multiple points, and even fractions of points can be purchased.

When Should You Buy Mortgage Points?

There’s a “break even” point on mortgage points. It’s when you’ve saved more in payments than you paid for the points. Typically, it takes a few years for that to happen. Do the math for your mortgage and make sure you’ll be in your home at least as long as it’ll take for you to break-even.

When Shouldn’t You Buy Points?

Generally speaking, if you have enough cash to purchase mortgage points, you may be better off putting that money towards your down payment instead. A larger down payment could get you a lower interest rate, reduce the amount you’d pay for mortgage insurance (or eliminate it all together), or reduce your monthly payment.

Mortgage points are a long-term strategy to save money, so if you don’t plan to be in your house long they may not be worth the cost. If you’re interested in mortgage points, talk to your local home lender. They can run all the scenarios to see how best to pay off your loan.